Why Should I Add Liquidity on OMNIA Token on Decentralized Exchanges?

Any successful token in the cryptocurrency space needs as much liquidity as possible on the market to allow existing token holders to cash out or increase their positions and enable large investments to be made without affecting its price heavily.

OMNIA, just like any other token, also has liquidity needs that can be fulfilled in a truly decentralized manner through its community. The OMNIA team encourages users to provide liquidity by making it super simple to do so and creating incentives.

Providing liquidity is an added incentive to being token holders, as it allows users to generate income from their holdings. There are three ways to earn with the OMNIA Protocol:

- Register nodes with OMNIA

- Liquidity mining

- Yield farming pools

The first method requires users to join the node register waiting list and set up a blockchain node. Node providers and relayers stake OMNIA to join the network and commit to performance metrics and are rewarded in OMNIA.

For this article, however, we’re focusing on the latter two methods, which take place in decentralized exchanges.

Liquidity mining

The first-ever decentralized exchanges suffered from liquidity issues. In trying to implement traditional order books, they found that liquidity on-chain wasn’t enough for the sheer amount of tokens out there as most users flocked to centralized platforms.

Their solution was based on liquidity pools, which see token holders contribute their tokens to a pool and receive a share of its trading fees as a reward. Instead of using traditional order books, these DEXs rely on the liquidity in these pools to match trades and on blockchain oracles for pricing information.

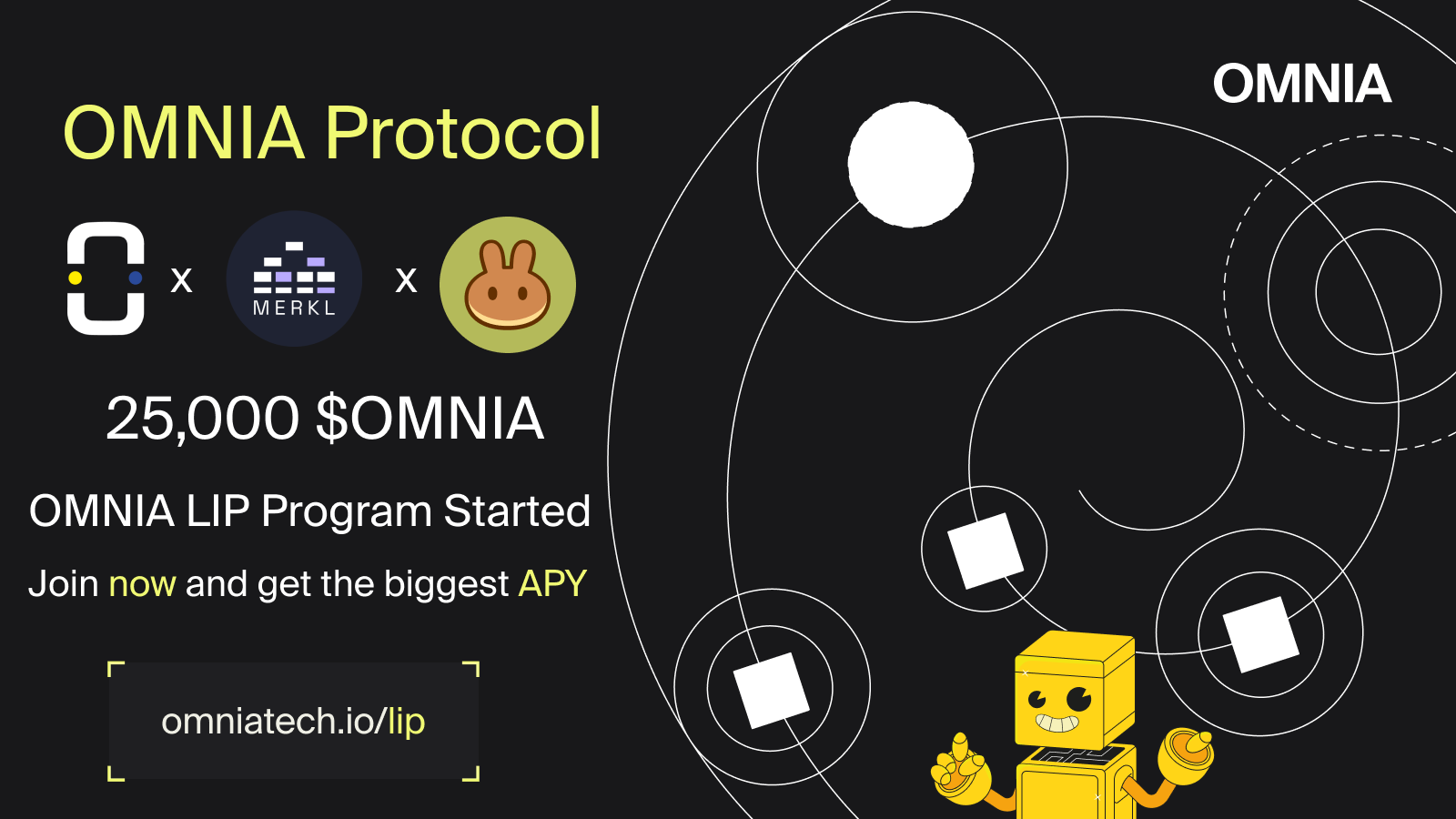

OMNIA will require liquidity on two major decentralized exchanges upon launch, one for the BSC Chain and one for Ethereum:

- PancakeSwap (BSC Chain)

- Uniswap (Ethereum)

As a reward to liquidity providers, OMNIA will send a share of the fees received to people who add liquidity to the ETH/OMNIA pair on Uniswap. Rewards will be distributed according to the amount pooled by each user.

Keep in mind that to contribute to a liquidity pool, users must deposit both tokens in a trading pair — in the one mentioned above, they would have to commit equal parts USDC/BUSD and OMNIA.

Farming pools

Users can also earn passive income through their OMNIA holdings by providing liquidity to farming pools, which are as easy and convenient to use as liquidity pools on Uniswap and PancakeSwap, with the added advantage of extra yield through farming rewards.

One of the platforms joining OMNIA in liquidity farming is Unicrypt. When users deposit funds into a liquidity pool, they must supply a one-to-one ratio of two crypto assets to the pool and receive liquidity provider (LP) tokens in exchange.

These tokens represent the user’s stake in the pool and can be used on other platforms that may then create new pools around them. Unicrypt is one such platform, allowing LP token holders to boost their earning potential further.

Yield farmers and liquidity providers are rewarded for providing liquidity to decentralized exchanges and ensuring new users can come and go as they please. However, two things need to be pointed out.

For one, an impermanent loss may lead to losses when providing liquidity. (Impermanent loss occurs when the weight of the deposited assets changes.) If the assets return to their original levels, the loss is reversed.

Moreover, the OMNIA token hasn’t yet been launched, which means these liquidity-providing methods are not yet available.